Latest from CoinDesk

-

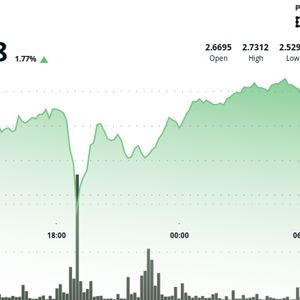

Bitcoin Shakes Off Powell Jitters: Crypto Daybook Americas

Bitcoin Shakes Off Powell Jitters: Crypto Daybook Americas2025-07-31 14:15

-

Germany’s AllUnity Launches BaFin-Regulated Euro Stablecoin EURAU

Germany’s AllUnity Launches BaFin-Regulated Euro Stablecoin EURAU2025-07-31 14:00

-

Whale Activity Surges as Bitcoin Builds Momentum Toward New Highs

Whale Activity Surges as Bitcoin Builds Momentum Toward New Highs2025-07-31 13:39

-

MicroStrategy's Market Hints at Strongest Downside Risk Since April

MicroStrategy's Market Hints at Strongest Downside Risk Since April2025-07-31 10:25