Latest News

-

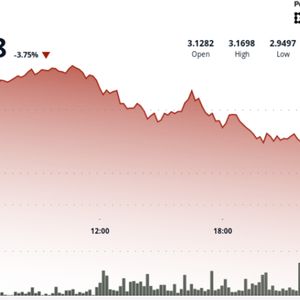

Devastating PEPE Trading Losses: James Wynn’s $1M Setback

Devastating PEPE Trading Losses: James Wynn’s $1M SetbackBitcoin World 2025-08-01 06:20

-

Spot ETH ETFs Surge: A Phenomenal 20-Day Inflow Streak

Spot ETH ETFs Surge: A Phenomenal 20-Day Inflow StreakBitcoin World 2025-08-01 06:10